Dubai Airport Free Zone (DAFZA) stands as one of the Middle East’s most strategically positioned and fastest-growing free trade zones, offering a comprehensive business ecosystem designed to facilitate international commerce, trade, and investment.

Established in 1996 as part of Dubai’s strategic economic development plan, DAFZA has evolved into a thriving business hub hosting over 3,100 registered companies from more than 20 sectors, employing over 20,000 professionals worldwide.

The free zone’s proximity to Dubai International Airport, one of the world’s busiest aviation hubs, combined with its investor-friendly regulatory environment, world-class infrastructure, and substantial tax incentives, makes it an attractive destination for multinational corporations, startups, and mid-sized enterprises seeking to establish or expand their operations in the Middle East, Africa, and Asia-Pacific regions.

Strategic Location and Global Connectivity

DAFZA’s most distinctive advantage is its geographical positioning directly adjacent to Dubai International Airport, one of the world’s busiest aviation hubs connecting over 150 airlines to more than 220 destinations globally.

This strategic location provides businesses with unparalleled access to international markets and logistics networks, making it particularly advantageous for companies operating in aviation, cargo handling, and time-sensitive industries. The free zone’s infrastructure is specifically designed to facilitate seamless integration with Dubai International Airport’s operations, offering 24-hour customs services and rapid cargo clearance through dedicated logistics centers.

Companies operating within DAFZA benefit from around-the-clock border operations, meaning businesses can clear goods and process shipments at any time, not just during standard business hours, significantly reducing delays and accelerating supply chain operations.

The proximity to the airport extends beyond logistics convenience; it positions DAFZA as an ideal gateway for companies seeking to establish regional headquarters, distribution centers, or operations hubs that require immediate access to global markets.

For trading companies, aviation service providers, and international logistics firms, this location advantage translates into tangible cost savings and operational efficiencies. The integrated infrastructure ensures that tenants can easily move goods in and out of the free zone, with efficient connectivity to Dubai’s main business districts and other economic hubs.

Comprehensive Business Services and Infrastructure

DAFZA provides an extensive array of business support services and modern facilities designed to meet the operational requirements of contemporary enterprises. The free zone encompasses multiple facility types, including state-of-the-art office spaces, flexible co-working environments, customizable warehouses with advanced storage capabilities, retail outlets, and specialized industrial units.

The zone’s infrastructure spans approximately 696,000 square meters across 18 buildings and 256 warehouses, offering businesses choices appropriate to their specific operational needs and scalability requirements.

Beyond physical infrastructure, DAFZA operates dedicated Business Centers equipped with professional meeting facilities, including the DEIRA Meeting Room, Al-Wasel Meeting Room (20-person capacity), Jumeirah Conference Room (30-person capacity), Al Majlis Function Room (200-person capacity), and a state-of-the-art Auditorium accommodating 225 people. These spaces feature video and audio conferencing capabilities, wireless presentation systems, recording equipment, and various technical amenities designed for modern business communications and events.

Operational support services extend to facility management, telecommunications, information technology solutions, security, and administrative services. DAFZA operates 24/7 security systems with comprehensive CCTV surveillance, established emergency protocols including fire safety systems, and professional housekeeping and building maintenance services.

The free zone maintains partnerships with major service providers including Emirates NBD, Abu Dhabi Islamic Bank, Etisalat, and Du for banking, telecommunications, and other essential business services. On-site amenities include food courts, retail establishments, travel agencies, fitness facilities, and medical services, creating a comprehensive ecosystem that reduces the need for businesses to manage non-core operational activities externally.

Tax Incentives and Financial Benefits

DAFZA offers some of the most attractive tax incentives in the region, fundamentally transforming the financial dynamics of businesses operating within its boundaries. Companies established in DAFZA benefit from a complete exemption of corporate tax for up to 50 years, provided they maintain Qualified Free Zone Person (QFZP) status. Under the Federal Decree-Law No. 47 of 2022 corporate tax regime that became effective June 1, 2023, companies classified as QFZPs are eligible for a 0% corporate tax rate on qualifying income generated from transactions with businesses outside the UAE, within the same free zone, or with other free zones.

In addition to corporate tax exemptions, DAFZA companies benefit from complete personal income tax exemptions for all employees. This dual tax advantage makes the free zone particularly attractive for attracting international talent and maintaining competitive compensation packages. The free zone also provides customs duty exemptions on imported and exported goods, and VAT exemptions on transactions conducted within the zone, further reducing overall operational costs.

Financial flexibility represents another significant advantage; companies operating in DAFZA can repatriate 100% of their earnings and capital without any restrictions or limitations. This provision means that profits generated by international companies can be transferred out of the UAE without facing currency restrictions or special approval requirements, addressing a major concern for foreign investors seeking to maximize returns.

Ownership Structure and Business Control

DAFZA permits 100% foreign ownership of businesses, eliminating the requirement for local partnerships that typically applies to mainland Dubai operations. This provision grants international investors complete operational control over their enterprises without needing to accommodate local partner interests.

Foreign companies can establish either Free Zone Companies (FZCO) or Branch entities, each with distinct characteristics suited to different business models. Free Zone Companies are independent legal entities with their own liability, while Branches operate as extensions of the parent company, sharing the same business name and activities.

License Types and Business Setup Process

License Types in DAFZA

DAFZA offers a diverse range of licenses to accommodate different business models and industries. The primary license categories include:

1. Trade License

This license allows businesses to import, export, re-export, distribute, and store specific goods. Companies can also opt for an E-commerce License under this category to trade goods and services online.

2. Service License

Designed for service-oriented businesses, the Service License enables consultancy, IT, and other professional services specified in the license agreement.

3. Industrial License

This license is ideal for companies involved in light manufacturing, packaging, and assembly operations, focusing on value-added production activities within the Free Zone.

4. General Trading License

A General Trading License authorizes businesses to import, export, re-export, store, and distribute a wide variety of products without restrictions to specific categories.

5. Dual License with DET (Dubai Economy and Tourism)

The Dual License allows DAFZA-based companies to operate in both the Free Zone and Dubai mainland without maintaining a separate mainland office. This provides greater market reach and operational flexibility.

6. Talent Pass License

Targeted at freelancers and solo professionals in fields like media, technology, or education, the Talent Pass License allows individuals to offer their services legally and includes visa eligibility.

Some other categories include Trade Licenses for importing, exporting, re-exporting, and distributing specific products; Service Licenses designed for service-oriented businesses such as consultancy, IT services, and professional services; Industrial Licenses for light manufacturing, packaging, and assembly operations; E-commerce Licenses for online business enterprises; General Trading Licenses permitting broad import-export and distribution activities.

Explore: Sharjah Media City: A Premier Free Zone for Creative Entrepreneurs and Digital Businesses

Business Setup Process

Setting up a business in DAFZA is efficient and typically takes only 2–4 weeks from initial submission to operational commencement, provided all documentation is in order.

Step 1: License and Business Activities

- Select the appropriate company type and license category.

- Decide on business activities permitted within your license.

Step 2: Secure Office Space

-

Choose from available office facilities suitable for your operational needs.

Step 3: Submit Application Package

- Complete the application form.

- Provide a detailed business plan.

- Submit passport copies of shareholders and officers.

- Provide six months of personal bank statements and bank reference letters.

Step 4: Obtain Initial Approval

-

Wait for initial review and approval by DAFZA authorities.

Step 5: Finalize Registration and Document Attestation

- Provide notarized and attested ownership declarations.

- Submit power of attorney documentation for managers or directors.

- Finalize and sign office rental agreements.

- Execute specimen signatures in the presence of DAFZA officials.

Related: Business Setup in UAE and Emirates [A Complete Guide]

This streamlined approach ensures new businesses can start quickly and with minimal administrative burden, making DAFZA a highly attractive location for company formation.

Visa and Employment Services

DAFZA facilitates employee sponsorship through a systematic visa allocation process based on office size and license type. Employers can sponsor employment visas for their workforce, enabling them to hire international talent and build diverse teams.

The visa sponsorship system requires employers to maintain proper employment contracts aligned with UAE labour law, provide mandatory health insurance coverage, and ensure visa renewals occur within stipulated timelines. DAFZA companies can also sponsor dependent visas for spouses, children, and other immediate family members, allowing employees to relocate their families to Dubai.

Visa quotas vary based on office space allocation and business licensing tier. For industrial park warehouses in DAFZA’s specialized industrial zone, companies with spaces of 350 square meters or below receive an entitlement of 20 employment visas, while those with spaces exceeding 350 square meters receive 30 employment visas. This flexible visa quota system enables businesses to scale their teams proportionally with their operational expansion.

Industrial and Sectoral Diversity

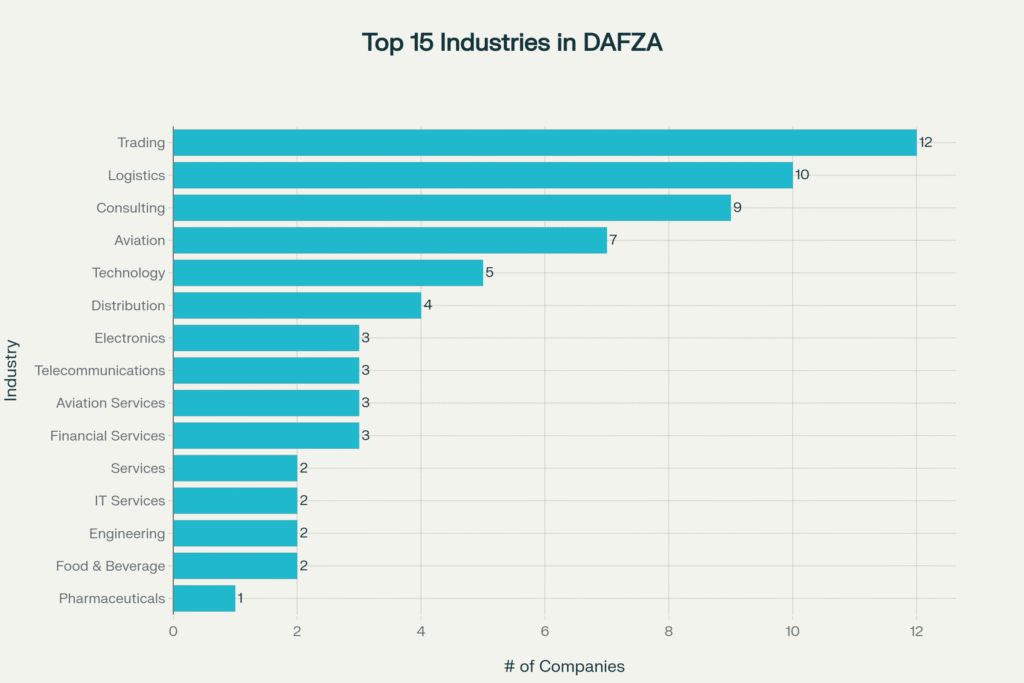

DAFZA hosts companies across an exceptionally broad spectrum of industries and business sectors, reflecting the free zone’s position as a truly diversified economic hub. Major sectors represented include

- Aviation and aerospace

- Telecommunications and information technology

- Pharmaceutical and cosmetics manufacturing

- Food and beverage production

- Jewelry and luxury goods

- Engineering and building materials

- Logistics and freight handling

- International trading.

The presence of globally recognized companies, including Rolls-Royce, Roche, Boeing, and Chanel, demonstrates DAFZA’s appeal to multinational corporations seeking strategic operational bases in the region.

Recent growth patterns show particular momentum in emerging sectors. E-commerce and AI-powered logistics have emerged as rapidly expanding industries within DAFZA, driven by the regional growth of online shopping and the free zone’s advanced logistics infrastructure.

The professional, scientific, and technical services sector experienced 33% growth in 2024, while the information and communication sector grew by 24%, reflecting strong demand for technology and professional services. Financial and insurance services grew by an impressive 35% in 2024, and transportation and storage sectors recorded 33% growth, indicating robust expansion in services supporting international trade.

Competitive Positioning Within Dubai’s Ecosystem

DAFZA operates as a component of the Dubai Integrated Economic Zones Authority (DIEZ), a unified structure established in 2021 that also includes Dubai Silicon Oasis (DSO) and Dubai CommerCity. This integration represents part of the Dubai Economic Agenda, focusing on diversification and sustainable economic development. (Source)

DIEZ reported an 18.4% growth in revenue and 7.8% increase in EBITDA in 2024 compared to the previous year, alongside a 9% growth in the number of registered companies. The employee base within DIEZ’s zones grew by 21% in 2024, bringing the total workforce to over 84,000 professionals, demonstrating substantial economic activity and job creation. (Source)

Explore: All About Meydan Free Zone Dubai

Financial Performance and Contribution to Dubai’s Economy

The economic impact of DAFZA extends significantly beyond its immediate operational boundaries. DAFZ contributes approximately 4.7% to Dubai’s overall Gross Domestic Product.

Non-oil trade volumes within DAFZ reached AED 162 billion in 2021, representing a remarkable 36% growth from the previous year’s AED 119 billion, demonstrating the zone’s critical role in facilitating non-oil economic activity and international commerce. The zone’s contribution to Dubai’s economic diversification strategy underscores its importance as a cornerstone of the emirate’s business infrastructure.

FAQs

Can I transfer my residency visa from DAFZA to DMCC?

Transferring a residency visa from DAFZA to DMCC involves canceling the existing visa sponsored by DAFZA and applying for a new visa sponsorship through DMCC. The process typically requires compliance with the visa regulations of the new free zone and Dubai immigration authorities. It is advisable to coordinate with the visa and PRO services of both free zones to ensure a smooth transition.

Who is the CEO of DAFZA?

The current Director General of Dubai Airport Free Zone (DAFZA) is Amna Lootah, who has been serving in this leadership role since January 2022. She brings over 20 years of experience in finance, marketing, innovation, and customer experience relevant to DAFZA’s strategic development.

How to get a DAFZA gate pass?

To obtain a gate pass for entering Dubai Airport Free Zone, employees and visitors typically need to be sponsored or registered by a company operating within DAFZA. The sponsoring company must apply for the gate pass through DAFZA’s security and access control system. Visitors might need to provide identification and have prior approval from the relevant company or DAFZA authorities.

How to enter Dubai Airport Free Zone?

Access to Dubai Airport Free Zone is controlled and restricted to authorized personnel and visitors. To enter, individuals generally require valid identification, a sponsor within the free zone, or official business purpose approval. The free zone has security checkpoints with strict access protocols. Visitors are advised to coordinate with the company they are visiting in DAFZA to arrange proper entry clearance.

These answers provide practical guidance on residency visa transfers, leadership, and access procedures at DAFZA. For specific and up-to-date procedures, contacting DAFZA’s customer service or official representatives is recommended.